Guest Blogger Jillian Sidoti: Powerful Tools to Raise Big Money

Jillian Sidoti of Trowbrdge, Taylor, and Sidoti probably has more experience working with real estate entrepreneurs to raise money than ANYONE in the U.S. So what does she think of the Jobs Act?

POWERFUL TOOLS TO RAISE BIG MONEY: REG D, RULE 506(C), REG A+ & CROWDFUNDING

By Jillian Sidoti

On June 19, 2015, the SEC fully adopted Title IV of the JOBS Act, with the objective of facilitating easier access to private capital formation for small companies. Regulation A+ updates and expands on the former Regulation A exemption for unregistered public offerings, which previously had a $5 million annual cap, and carves out two new sets of rules, Tier 1 and Tier 2, (which the SEC collectively calls Regulation A+), with annual limits of $20 million and $50 million, respectively, that small securities issuers can legally use to advertise and raise capital from private investors.1

In September 2013 the SEC authorized advertising to accredited investors under a new Regulation D, Rule 506(c) exemption pursuant to Title II of the JOBS Act.2 However, because it is estimated that only 10 percent of all investors in the U.S. are accredited, even with the ability to advertise, many issuers found themselves hitting a wall when it came to raising private money, and many otherwise-‐qualified investors were left out in the cold.

Regulation A+ seeks to solve that problem by allowing advertising of securities offerings to the general public with a streamlined pre-‐approval process. Under Tier I, anyone can invest with no financial limitations. Under Tier II, anyone can invest up to 10 percent of his or her net worth or 10 percent of his or her gross annual income (whichever is greater). This opens up a new audience for issuers who can’t access enough accredited investors to fund their deals, and who already know a lot of unaccredited (and deserving) investors who would like to invest with them.

WHY IS THIS IMPORTANT TO REAL ESTATE INVESTORS?

Real estate entrepreneurs commonly raise money from private investors in exchange for “promissory notes” or “investment contracts”, both of which fall within state and federal definitions of “securities”. An “investment contract” is an investment of money in a common enterprise with an expectation of profits based solely on the efforts of the promoter. SEC v. W. J. Howey Co. 328 U.S. 293 (1946). Under The Securities Act of 1933, all offers and sales of securities must be “registered” (pre-‐approved) unless exempt from registration. Serial borrowers whose business depends on repeatedly issuing promissory notes to private lenders, and investors who sell passive investment opportunities to private investors, must qualify for an exemption (by following a specific set of rules) unless they obtain pre-‐approval from securities regulators to sell the securities in a public offering.

Typically, small, private companies and real estate syndicators had to rely on exemptions under Regulation D of the Securities Act of 1933. Most Regulation D rules (called private placement offerings) prohibit general solicitation; restrict offers or sales to investors who meet certain financial qualifications, and some rules (Rule 504 and 505) limit the dollar amounts that can be raised.

1 The term “issuer” refers to a legal entity … that develops, registers and sells securities to the investing public in order to finance its own operations. www.investinganswers.com/financial-‐dictionary/investing/issuer-‐2236.

2 Per Rule 501, an accredited investor is an investor who earns a minimum of $200,000 a year as a single person; earns a minimum of $300,000 a year as a married couple; or has a minimum net worth of $1 million—exclusive of equity in their primary residence.

REG D, RULE 506(C), REG A+ & CROWDFUNDING

Under Regulation D, Rule 506(c), issuers can advertise their investment opportunities to the public, and there is no dollar limit, but they are limited to accepting funds from accredited investors (as defined under Rule 501). Under Rule 506(c), accreditation must be verified by tax return or income review, or through third-‐party verification.

Regulation A, pre-‐JOBS Act, was the only federal securities exemption that allowed issuers to raise money from unaccredited investors using general solicitation. However, the original Regulation A was not a popular choice, as it only allowed an issuer to raise up to $5 million in a 12-‐month period and required state pre-‐approval prior to advertising; and the legal and filing costs were prohibitive for such a small offering. Few affordable attorneys would take on Regulation A offerings and the approval process could be challenging, time-‐consuming and frequently delayed by both the SEC and the state securities agencies. For many, the ability to advertise wasn’t worth the cost or the effort, and they would instead fall back on the federal Regulation D and its restrictions or confine their offerings to a single state so they could operate under state exemptions (often limited to $1 million). Of the Regulation A offerings filed between 2008 and 2013, Attorney Jillian Sidoti of Trowbridge Taylor Sidoti LLP filed 40% of the real estate related filings and she filed the only Reg A real-‐estate related filing that was approved by the SEC in 2011. The adoption of Regulation A+, with its streamlined electronic filing process, is expected alleviate many of these issues.

Regulation A+, TIER 1

Regulation A+, Tier 1 is an amended version of the former Regulation A. Tier 1 issuers may now raise up to $20 million as opposed to the old $5 million limit. It is also expected that Tier 1 offerings will be eligible for filing through the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) system, which was previously unavailable and required voluminous paper filings. By being able to file Tier 1 offerings electronically, issuers will be able to see their uploaded filings in real time.

Tier 1 does not have any audit requirements. This is great for those issuers looking to save on audit and accounting costs as audits can be expensive, but the tradeoff is that audits give investors peace of mind and a sense of transparency. However, Tier 1 issuers must still get state pre-‐approval of the offering before they are allowed to advertise. This means that in order to sell its securities, a Tier 1 company must subject itself to the scrutiny of every state where it intends to sell securities. The review fees for such states (ranging from as little as $100 to $5,000 per state) could potentially exceed the cost of an audit.

Regulation A+, TIER 2

The new Regulation A, Tier 2, will allow issuers who meet certain requirements to raise up to $50 million in a 12-‐month period. Tier 2, like Tier 1, will allow for general solicitation and uploading of filings to the EDGAR system. Tier 2 issuers will be required to perform a pre-‐approval audit prior and for a minimum of three years post-‐approval. The Tier 2 issuer must also hire a ‘transfer agent’ and has certain ongoing reporting requirements similar to a public ‘smaller reporting company,’ including annual, semiannual and current event reports.

Despite the audit and additional filing requirements, Tier 2 pre-‐empts the state pre-‐approval requirements of Tier 1, making Tier 2 a more appealing option for those who wish to raise money from investors in multiple states. The notice requirements required by the states are expected to be similar to a Form D filing under Regulation D.

Both Tier 1 and Tier 2 issuers will be able to enjoy the benefits of “testing the waters.” Issuers will be able to file advertising materials to be used to gauge interest prior to approval of the offering. This is helpful for figuring out what to offer investors, what would be of interest to investors and to build a prospective investor list. They simply can’t collect any money until the offering has been approved.

REG D, RULE 506(C), REG A+ & CROWDFUNDING

CROWDFUNDING YOUR DEALS IN A POST JOBS-‐ACT WORLD

Crowdfunding is the latest buzzword in capital-‐raising since enactment of the federal JOBS Act in April of 2012. The word “Crowdfunding” has become a generic term used to describe advertising for investors authorized under various sections of the JOBS Act. A brief history of Crowdfunding follows:

- Crowdfunding was allowed pre-‐JOBS Act, but only for not-‐for-‐profit ventures. Pre-‐JOBS Act, for-‐profit companies could not advertise for investors unless they had an approved intra-‐state offering (with all investors, assets, and issuer in one state), an SEC-‐approved Regulation A offering, or a public offering.

- Title II of the JOBS Act directed the SEC to draft regulations allowing advertising of offerings limited to accredited investors, which resulted in the SEC’s adoption of Regulation D, Rule 506(c) in September 2013. After adoption, the media and capital-‐raising marketplace quickly adopted the term Crowdfunding to apply to advertising of such offerings.

- Title III of the JOBS Act authorized the SEC to draft regulations for a new “Crowdfunding exemption” that would allow issuers to raise up to $1 million/year, in offerings that could be advertised and sold via SEC-‐approved “Funding Portals”, where anyone could invest up to $2,000 or up to a maximum of 10% of their annual income of net worth (subject to certain limitations). In its proposed regulations for Title III, SEC introduced the term “Regulation Crowdfunding”, to differentiate Title III offerings from the media’s generic use of the term. Unfortunately, the proposed rules for Regulation Crowdfunding appear to have fallen into a regulatory quagmire, with dissension among FINRA (the self-‐regulatory organization for licensed securities broker/dealers), the SEC, and state securities regulators as to their final form. Until the final rules are adopted (if ever) Regulation Crowdfunding under the Title III Crowdfunding exemption described in the JOBS Act is still illegal. It is postulated that additional Regulation Crowdfunding legislation may be proposed to resolve these issues.

- Title IV of the JOBS Act authorized Regulation A+ offerings. So now advertising of Regulation A+ offerings is also being lumped in with the generic use of the term ‘Crowdfunding’.

After the SEC’s implementation of Title II and Title IV of the JOBS Act, many “Crowdfunding Platforms” have arisen whose sole purpose is to advertise eligible Rule 506(c) and Regulation A+ offerings. Crowdfunding Platforms are merely a means for an issuer to advertise an existing securities offering, meaning the issuer must already have an offering under Rule 506(c) or Regulation A+ in-‐hand before they can use a Crowdfunding Platform to promote it to their investors. These Crowdfunding Platforms are of four primary types:

- Securities broker-‐dealers who advertise eligible offerings to their prequalified investors;

- Registered investment advisers who participate and/or recommend eligible offerings to their clients;

- Crowdfunding platforms who advertise eligible offerings to their database of investors for a marketing fee and/or back-‐end profits; and

- The issuer’s own website.

So, although it is true that issuers can now advertise their offerings to investors under federal law, currently under Rule 506(c), and later under Regulation A+ (once an issuer’s specific offering has been approved), the new rules are not a wholesale license for everyone to advertise real estate investment opportunities to anyone at anytime. There are legal requirements for both Rule 506(c) and Regulation A offerings that must be met; the proper disclosure documents and investor agreements must be drafted; and regulatory filings must be submitted to the SEC and state regulators; and in the case of Regulation A+, the offering must be pre-‐approved before funds can be collected. Only then can an issuer advertise and collect money from investors, subject to applicable investor verifications, limitations, and reporting requirements.

REG D, RULE 506(C), REG A+ & CROWDFUNDING

The Bottom line: Regulation A filers will be able to enjoy the perks of Crowdfunding, such as using a Crowdfunding Platform to advertise and sell their securities, or to advertise their offering on their own website. Unlike Rule 506(c) filers however, Regulation A filers will not be restricted to accredited investors. Tier I offerings will be subject to SEC and state pre-‐approval, but no audits. Tier II offerings will be subject to SEC approval and state notice filings, ongoing filing and annual audit requirements.

Is Regulation A+ the right choice for all issuers? No, but it is ideal for seasoned issuers who have already had a number of private placement offerings and/or those who are ready to take their real estate investment companies public, and who have time to wait before they need to start raising money. Due to the anticipated 6-‐month+ timeframe for approving Regulation A+ offerings, this isn’t a good choice for someone with a property under contract and a 90-‐day closing date (who would be better served with a Rule 506 offering, but it can be an excellent choice for hard money lenders, serial borrowers, fix and flippers, or commercial investors with track records who want to raise money to buy multiple properties under a single offering or “blind pool” scenario.

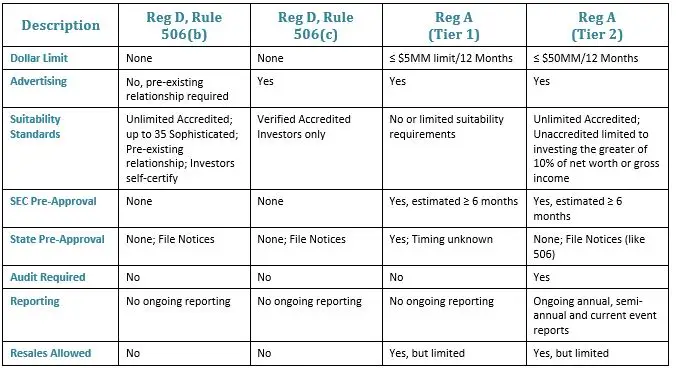

Below are some highlights of the differences between Regulation D, Rule 506 and Regulation A+:

WHAT’S YOUR QUESTION?

Jillian Sidoti and Kim Lisa Taylor are partners in the law firm Trowbridge Taylor Sidoti LLP, whose law firm specializes in corporate and real estate securities matters such as private placement and public securities offerings including Regulation D, Regulation A+, Form 10, and From S-‐1 filings. Both Jillian and Kim are frequent speakers at seminars educating real estate investors on how to legally raise capital for their real estate investment projects or new business ventures. Contact Jillian Sidoti at Jillian@SyndicationLawyers.com or (323) 799-‐1342, or Kim Lisa Taylor @ Kim@SyndicationLawyers.com or (904) 584-‐4055 to schedule a free consultation.

NOTE: This information is of a general, educational nature and may not be construed as legal advice pertaining to your specific offering, exemption, or situation. Any such advice must be sought from your own attorney pursuant to an attorney-‐client relationship, after consideration of your specific facts or questions. © 2015 Trowbridge Taylor Sidoti LLP v2.

Leave a Reply