IC form of the month: the creative finance “control chart”

I’ve become obsessed lately with the idea of how to explain in simple, almost graphical terms concepts in real estate that are actually kind of difficult to get across without REAMS of supporting explanation.

In fact, my next project (which you’ll get to take advantage of as soon as I manage to figure it all out) is to create a simple explanation of the steps to learning what you need to know in order to do real estate deals.

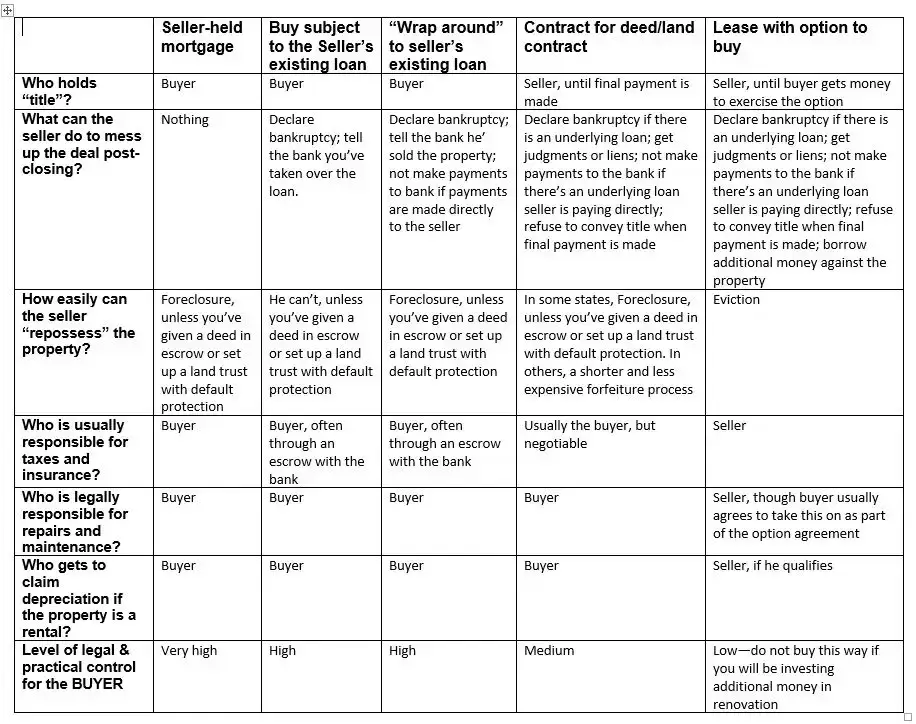

But my most recent one is this: creating what I hope is a really understandable chart for comparing various types of creative financing in terms of who holds the control, what the risks are, and who gets various benefits.

I’ve compared the most common types of creative seller financing: buying with an owner-held mortgage, buying subject to, buying with a wrap mortgage, buying with a land contract/contract for deed, and leasing with an option to buy.

Along the left column, you’ll see the items that are being compared. These include:

- Who holds the title? In other words, if I went to the local courthouse and pulled the deed, whose name would be on it? Having the deed to a property automatically confers a whole lot of control to the deed holder; with the deed, you can sell the property, change the property, encumber the property, and do a lot of other things that a tenant can’t do.

- What can the seller do to mess up the deal post-closing? I always compare seller finance deals to relationships. If a cash purchase is a one-night stand (I’ll see ya at the closing, but never again), seller financing creates more of a marriage where the buyer and seller both have ongoing expectations and responsibilities. The way in which a buyer can mess up a creative deal is obvious: don’t pay the seller (or the seller’s bank, if that’s the agreement). The ways in which a seller can mess up a deal depend on the level of control the buyer has. If the buyer has the deed and there’s no seller-originated bank financing involved, there’s basically nothing the seller can do mess it up as long as the buyer continues to make payments. On the other hand, if the seller continues to hold the deed, as in a land contract or lease/option, there are a whole slew of things he can do, intentionally or inadvertently, to cause headaches, screw up the title, or torpedo the whole deal.

- How easily can the seller repossess the property if the buyer defaults? This varies enormously depending on the structure of the deal, and it can be very important to certain sellers who are nervous about the idea that you won’t pay them. Not all are, but when they are, it’s nice to be able to give them options that make them comfortable

- Who is usually responsible for taxes and insurance? This is another way of asking the question, would taxes and insurance usually be assumed to be part of the monthly payment paid to the seller or bank (and therefore actually paid BY the seller or bank), or would it usually be assumed to be IN ADDITION TO the monthly payment, and paid directly by the buyer?

- Who gets to claim depreciation, if the property is ultimately used as a rental? In other words, who does the IRS think is the owner (it’s not always who the law thinks it is, as you’ll see)

- What is the level of control for the BUYER? By this, I mean, what is the level of risk that the seller can or will withhold the deed, mess up the title, or otherwise do something that would cause the buyer to lose some or all of his investment or profit? This is CRUCIAL when you’re planning to buy a piece of property that will require an investment of cash—yours or someone else’s—for upfront payment or repairs. The higher the level of risk, the less money you want to put into the deal, which is why lease/options are commonly used to control pretty houses that need little work and require little upfront money, but NOT properties that need a ton of rehab.

Examine the chart and give me your feedback: is it helpful in understanding these strategies? Would you like to see more of these comparisons for other strategies?

This is awesome! Thanks Vena.

Love it! Lays it all out and makes it easy to compare strategies. Thanks!

Hi Vena. Here is some feedback:

1. How easily can the seller repossess the property [if the buyer defaults]? I would add the “if the buyer defaults” to your chart. There is enough room for this text and it makes it clearer at first glance (I was wondering how seller could repossess without buyer not doing something to warrant such action).

2. I would provide footnotes for “Foreclosure, unless you’re given a deed in escrow or setup a land trust with default protection”. I can only guess that having a deed in escrow lengthens the time of the foreclosure and allows the buyer to “catch up” or that by having land trust, it allows buyer to stall by firing trustee or ??

I like the layout of the content very much. It is organized and easy to follow. Yes, I understand there is more to what you have given in the chart. Creative financing is something I want to do and have been studying how to do it. My biggest hurdle is getting an attorney to understand what I want to do and OK it and a realtor to write a state contract. Yes, I would like to see more training on it. Thank you for a great job!

Mary–if you belong to a real estate association, ask around about which attorney everyone else is using. It IS, for sure, a challenge trying to find the one, but when you do, it’s worth it.